Alaska's Rural Residents May See Nearly $2,000 Annual Insurance Increase, Say Researchers

FROM THE ALASKA BEACON https://alaskabeacon.com/ Health insurance will cost more for millions of Americans — especially rural residents Th...

FROM THE ALASKA BEACON

https://alaskabeacon.com/

Health insurance will cost more for millions of Americans — especially rural residents

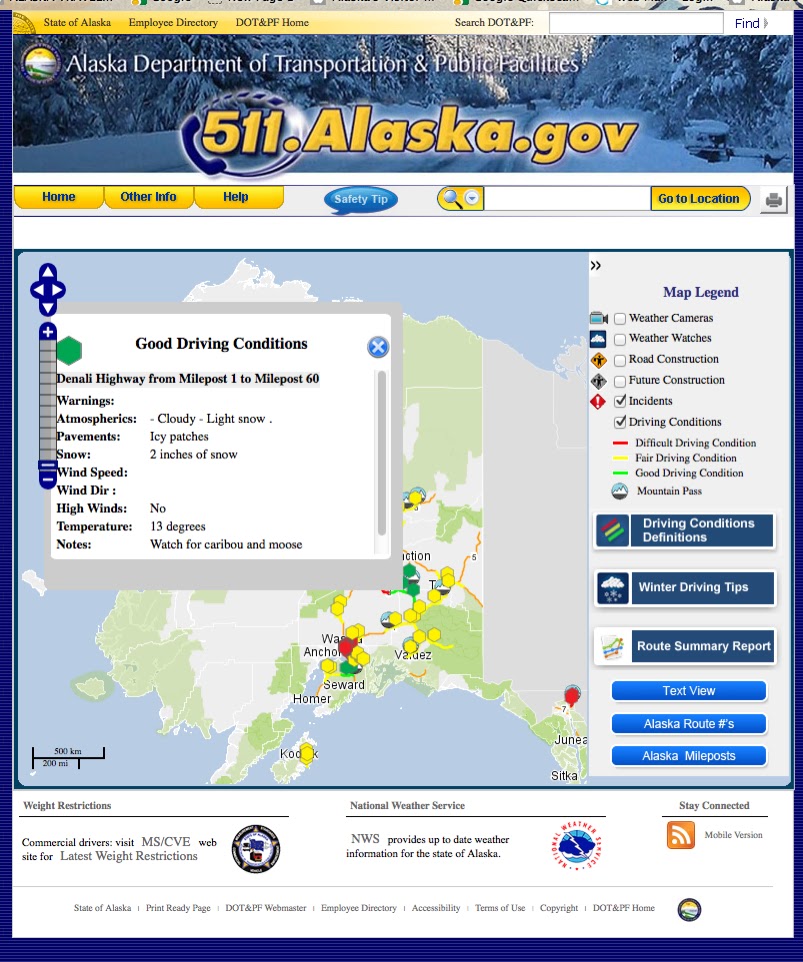

The expiration of tax credits at the end of this year will have a huge impact. States where rural enrollees are expected to see the highest cost increases are Wyoming, Alaska, and Illinois.

A combination of Trump administration policies will make health care coverage more expensive for people who purchase plans from health insurance marketplaces — and rural residents will be hit the hardest, according to a new analysis.

Researchers from the Century Foundation say Trump administration policies — especially its refusal to ask Congress to extend Biden-era tax credits that are set to expire at the end of this year — will boost out-of-pocket premiums by 93% in the 32 states that allow the federal government to operate their Affordable Care Act insurance marketplaces. New rules and tariffs will have a smaller impact.

Rural county residents in those states will see an increase of 107%, while residents of urban counties will pay 89% more, according to the analysis by the Century Foundation, a left-leaning research nonprofit.

Insurers participating in the Affordable Care Act marketplaces are proposing a median premium increase of 18% for 2026 — the biggest jump since 2018 and 11 points more than the growth from 2024 to this year. That bump would come on top of the increase resulting from the expiration of the tax credits and the other policy changes.

About 2.8 million people who are enrolled in marketplace plans in the 32 states live in rural counties, including 776,000 adults between the ages of 55 to 64 and more than 223,000 children, according to the Century Foundation.

“Rural residents tend to be older. They may be more likely to have chronic illness at the same time,” said Jeanne Lambrew, director of health care reform at the foundation. “It costs more, both because they have somewhat greater needs and less access to health care.”

Millions will see rise in health insurance premiums if federal subsidies expire

The researchers calculated that average annual premiums for rural residents will increase by $760 — 28% more than the expected average increase for urban residents. States where rural enrollees are expected to see the highest cost increases are Wyoming ($1,943), Alaska ($1,835), and Illinois ($1,700).

Many of the states with a large number of rural residents have chosen not to expand Medicaid under the Affordable Care Act, meaning many people who earn between 100% and 138% of the federal poverty level, between $15,650 and $21,597 for an individual, get their coverage from an insurance marketplace, Lambrew said.

Of the seven states where 10% or more of rural residents are enrolled in marketplace plans (Alabama, Mississippi, Nebraska, North Carolina, South Carolina, Texas and Wyoming), only two — Nebraska and North Carolina — have expanded Medicaid.

State officials in Pennsylvania recently advised residents who use the marketplace that they should closely examine the plans that are available.

“This year, even more than previous years, Pennsylvanians should consider shopping around to find the best plans to meet their individual needs, at a price that makes sense for their current financial situation,” Pennsylvania Insurance Commissioner Michael Humphreys said in a statement released at the beginning of this month.

Lambrew said the increases will force many people to forgo insurance altogether.

“It’s harmful for those individuals in terms of their own health and life expectancy. It’s harmful for our providers, because they’re now dealing with people who are sicker and in the wrong settings, and it’s kind of expensive for our society,” Lambrew said.

“We know health insurance matters, so having these large potential increases on uninsured Americans is distressing.”

Stateline is part of States Newsroom, a nonprofit news network supported by grants and a coalition of donors as a 501c(3) public charity. Stateline maintains editorial independence. Contact Editor Scott S. Greenberger for questions: info@stateline.org.