With U.S. Takeover Of Venezuelan Oil, Governor Plans "Seasonal Taxing" In Alaska

GOVERNMENT & POLITICS Dunleavy to propose ‘temporary, seasonal sales tax’ in Thursday’s Alaska State of the State address The governor...

Dunleavy to propose ‘temporary, seasonal sales tax’ in Thursday’s Alaska State of the State address

The governor’s final annual speech to the state legislature will be highlighted by his pitch for a long-term plan to fix state finances

Alaska Gov. Mike Dunleavy is expected Thursday evening to detail his plans for a long-term plan to balance Alaska’s expenses and revenue.

“There will be a temporary, seasonal sales tax concept put forward for discussion with the legislature,” Dunleavy said Wednesday during a cabinet meeting open to reporters.

Will state lawmakers approve that idea?

“I don’t have the answer to that until we start having discussions,” he said.

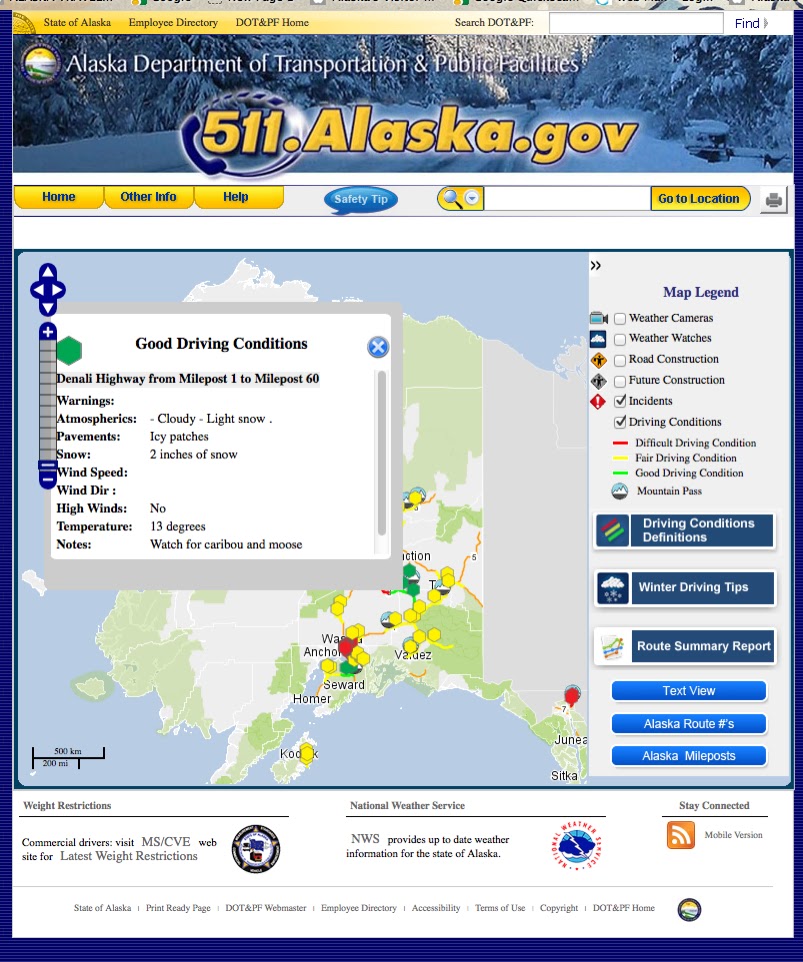

Since 2015, Alaska’s annual budget process has frequently been snarled by low oil prices that have made it difficult for legislators and governors to balance the state’s books without spending from savings.

Alaska relies on oil revenue for almost a third of its general-purpose revenue, and for most of the past decade, the price of North Slope crude has been relatively low.

Alaska has never had a statewide sales tax, and it hasn’t had a statewide income tax since 1980.

Since 2018, the state’s No. 1 source of general-purpose revenue has been the proceeds of the Alaska Permanent Fund, followed by oil.

Dunleavy’s proposal will mark a major shift for the governor, who is term-limited and in the final year of his second term. For his first seven years in office, the governor has attempted to resolve the long-term imbalance in state finances by cutting services and spending.

On the rare occasions that legislators have passed new tax measures, Dunleavy has vetoed them, saying he will accept no tax bills that are not part of a complete fiscal solution.

The governor is expected to unveil his proposal for a complete solution on Thursday. He said he views any tax measures as a temporary “bridge” until the North Slope begins producing more oil and a proposed trans-Alaska natural gas pipeline comes to fruition.

“The proposal and the fiscal plan has multiple components, and basically what it is, it’s a road map to inject stability, especially over the next five years when revenue is not quite what will be in the out-years,” he said.

In addition to proposing a statewide sales tax, the governor is expected to propose bills changing oil taxes and the Permanent Fund dividend.

“There’s always room for negotiation, but there’s two sides. That (goes) both ways,” he said.

Dunleavy’s remarks came during a Wednesday cabinet meeting that saw the leaders of state departments praise Dunleavy and point to ways in which the state’s position has improved since he entered office.

Crime is down, commissioners said, statewide employment is expected to reach a new historic high this year, and the state’s gross domestic product is also up.

Alaska remains near the bottom of national rankings in educational performance and violent crime, but Dunleavy said he wanted to emphasize that many of the state’s problems are improving.

“We wanted to make sure that people in Alaska know that … there’s a lot happening. These people are working hard. State employees are working hard. There’s a lot going on,” Dunleavy said. “It is a safer place. Is it the safest place in the country? No. That’s a motivator to keep going. We are creating more jobs. Can we, should we, do better? Absolutely. Keep going.”