Dunleavy Tells Lawmakers In Private Meeting That He Wants A Statewide Sales Tax

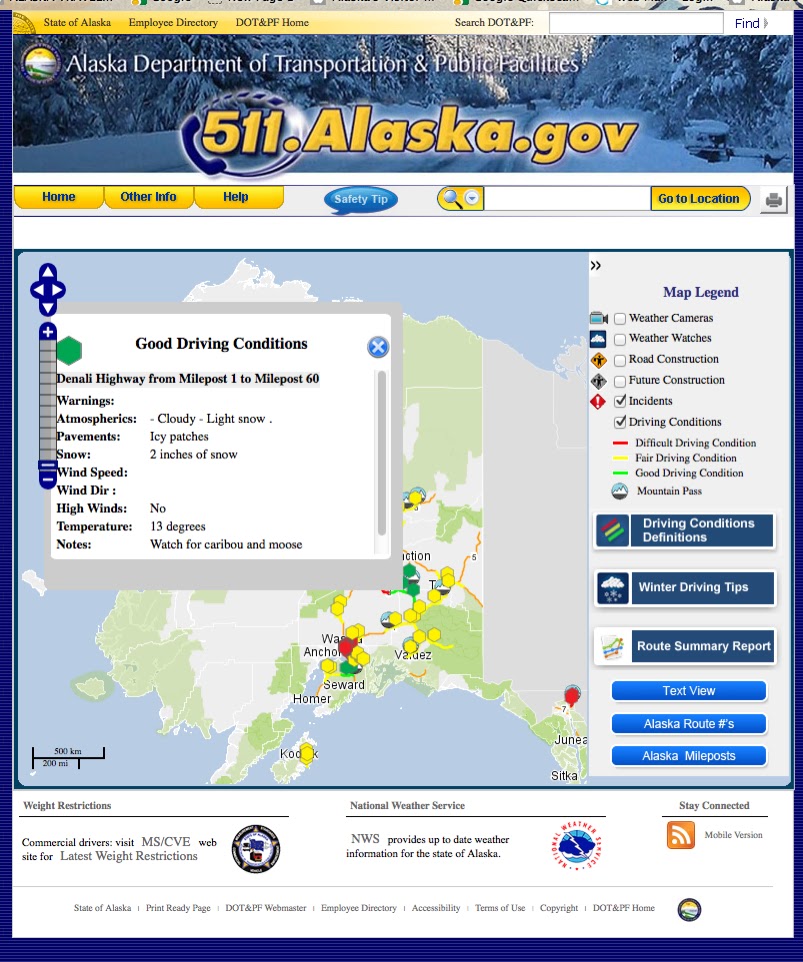

What Is A Sales Tax? Lawmakers in Alaska say the Governor Mike Dunleavy told them in a closed door meeting on Tuesday, April 18th that he...

What Is A Sales Tax?

Lawmakers in Alaska say the Governor Mike Dunleavy told them in a closed door meeting on Tuesday, April 18th that he's looking at a statewide sales tax.

According to Alaska Public Media, Cathy Tilton, a Republican from Wasilla, said Dunleavy indicated "he would be filing some bills of his own, and the bill that he is going to be filing will be a sales tax bill." Not much else is apparently known.

Currently, Alaska as a whole has no taxes, though some Alaska boroughs do tax their citizens. The state is facing budget problems.

|

| Governor Mike Dunleavy (State of Alaska photo) |

Meanwhile, the State House is looking at a $2,700 PFD.

WIKIPEDIA EXPLAINS SALES TAXES

Here is some information from Wikipedia about sales taxes...

A sales tax is a tax paid to a governing body for the sales of certain goods and services. Usually laws allow the seller to collect funds for the tax from the consumer at the point of purchase.

When a tax on goods or services is paid to a governing body directly by a consumer, it is usually called a use tax. Often laws provide for the exemption of certain goods or services from sales and use tax, such as food, education, and medicines. A value-added tax (VAT) collected on goods and services is related to a sales tax. See Comparison with sales tax for key differences.

Effects[edit]

Economists at the Organisation for Economic Co-operation and Development studied the effects of various types of taxes on the economic growth of developed nations within the OECD and found that sales taxes are one of the least harmful taxes for growth.[20]

Because the rate of a sales tax does not change based on a person's income or wealth, sales taxes are generally considered regressive. However, it has been suggested that any regressive effect of a sales tax could be mitigated, e.g., by excluding rent, or by exempting "necessary" items, such as food, clothing and medicines.[21] Investopedia defines a regressive tax as "[a] tax that takes a larger percentage from low-income people than from high-income people. A regressive tax is generally a tax that is applied uniformly. This means that it hits lower-income individuals harder".

Effects on local economies[edit]

Higher sales taxes have been shown to have many different effects on local economies. With higher taxes, more consumers are starting to reconsider where they shop,[22] according to a study conducted in Minnesota and Wisconsin,[23] where the sales tax was raised on cigarettes. Effects of higher sales tax were not shown immediately in sales, but about six months after the taxes were raised.[23] High sales taxes can be used to relieve property taxes but only when property taxes are lowered subsequently.[24] Studies that have shown this correlation were conducted in Georgia by cities raising sales tax and lowering property taxes. To combat sales loss, a city must be able to import consumers to buy goods locally.[23] If local sales taxes are too high, consumers will travel to other areas to purchase goods.

--From Wikipedia, Wednesday, April 19th, 2023